Like many of us, I am sure, I pay my gas bill by monthly direct debit. It is easy, I don’t have to try and remember it each month, or each quarter, it is the same amount each month and I know that by the start of autumn there will be a credit on my account to go towards the increased gas usage throughout the winter. All very simple – or it was.

A week ago I received an email from my suppliers advising me that my direct debit was going to increase by around four times for the next 12 months. I immediately contacted them and pointed out that I was not going to pay it, but I would allow them to take an increase of approximately 25%. Much to my surprise, they didn’t argue, but agreed to that. The moral of this story seems to be that if you don’t like the increase proposed for a direct debit payment, challenge it, you might just win.

We all know that energy costs are rising dramatically, whether it is oil (and therefore petrol and diesel) or gas (and therefore also electricity), and the media tell us on an almost daily basis, why – covid recovery increasing world demand, war in Ukraine causing reduced supplies from Russia. The knock-on effect, of course, being that almost all food and other goods now cost more both to produce and to get to the shops or our homes.

But does this need to be the case? Shortly after the end of WW2 the government took the view that the UK should be self-sufficient in food production, or at least of all essential foodstuffs. That policy has largely been ignored now for many years, but why does the principle not apply to energy?

In 1945 the only raw energy-producing material we had in any quantity was coal, and so a self-sufficient energy policy was not a practical one, but today is very different. North Sea oil is still abundant as is gas both from the North Sea and under our feet on the mainland (perhaps not literally under Rye, but certainly throughout many parts of the rest of the country).

I can almost hear the splutters of indignation from the green fraternity as they pick up their pens to tell us that we are signing the death warrants of both ourselves and our children, but why should this be?

There is no reason to change the target date for net zero and I am sure that we are all aware that it is better to use renewable sources rather than fossil fuels, but it is a fact that in 2022 renewables are not sufficiently developed in either quantity or efficiency to take over yet. The time will undoubtedly come when they can. In the meantime, petrol and even diesel are becoming cleaner and vehicle engines more efficient, the process of carbon capture is well understood and could be used in gas-burning plants more widely, and, best of all, it is all available on our doorstep.

We don’t need Russia and we don’t need to go cap in hand to the Arabs asking for a reduction in oil price – it is all here under our feet and gas, in particular, is obtainable relatively cheaply by fracking – and no, there won’t be an earthquake, nor will your house fall into a crack in the ground as the sort of idiots who glue themselves to motorways would have you believe.

So we have sources of energy that can be obtained easily with less cost than buying from foreigners who want to extract the last penny that they can from us. No need to buy at world market prices, we can set our own for home consumption and never again will I, or any of us, receive a demand from our utility company for an immediate fourfold increase in the price we pay them.

All it needs is a government brave enough to do it.

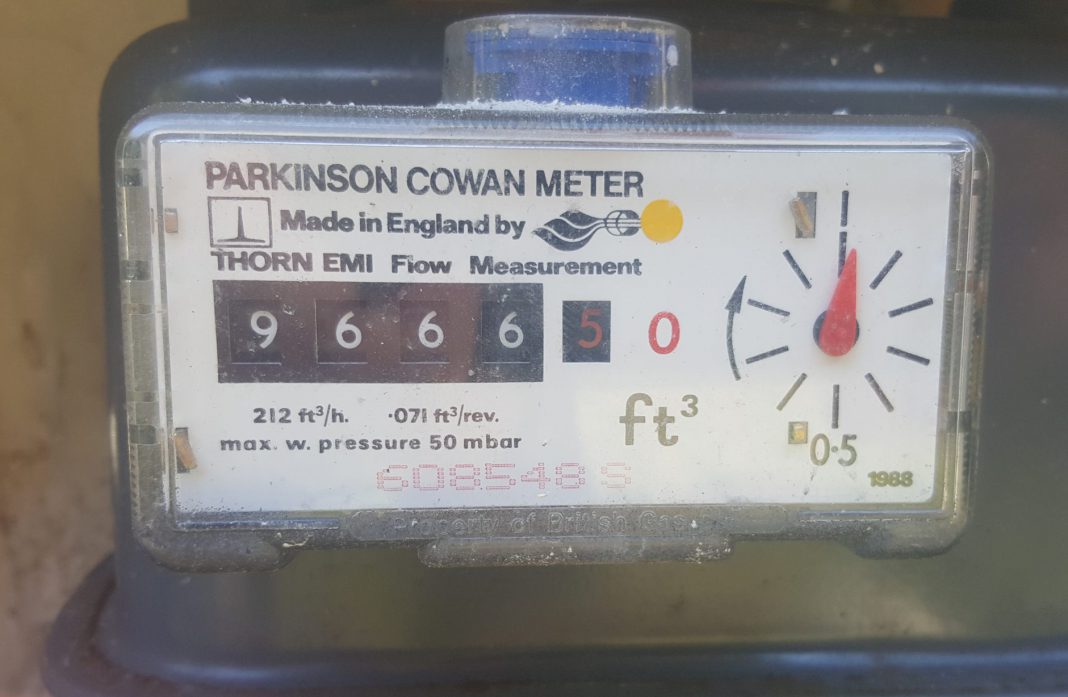

Image Credits: John Minter .

I admire and applaud the ‘idiots who glue themselves to motorways’ as selfless martyrs in highligting the insane, suicidal energy policies of this government. Have you not noticed, climate change is already happening? Due you even begin to grasp the ramifications, not just for us, but for people all over the world affected by increased temperatures, drought, fires, flooding, and crop failures? In the light of this, fracking is NOT the answer. We could have had cheap solar and wind power in abundance for years now, and people wouldn’t be suffering £5,000 fuel bills, if this and previous Conservative governments didn’t have their heads buried in the sand – or perhaps buried up the backsides of energy lobbyists – including those short-sighted enough to be promoting fracking for their own profit. We don’t incidentally have the right geology for it on a large scale, so its pointless anyway.

I would also draw your attention to a headline in today’s Telegraph: “Renewable energy is the only way out of this mess – On the basis of simple economics and self-reliance alone, the case for offshore wind and solar power is overwhelming”

The reason we don’t provide ordinary Britons British gas or oil at favourable prices is bcs there’s no profit in doing that. Simple. And the Devil take the hindmost…

As ‘N’ says, this circumstance should be impelling a more rapid adoption of renewables, not a scramble for fracked energy, a re-opening of coal mines and renewed oil exploration. None of those supposed remedies provide an immediate solution to the current crisis anyway. Supplies of new fracked gas would be a decade away, it’s not like a tap can be turned on.

This comment doesn’t provide much immediate comfort either, but when you think of the cost of oil to humanity, in pollution, global warming, war, human suffering, and in stagnant international diplomacy, it’s staggering that fossil fuels are still advanced as a solution to future energy needs.

I am amazed at the belief that onshore fracking will probide a long term solution to energy shortages. Sadly you are very mistaken, and indeed as you acknowledge that renewables are the future, perhaps you would agree that it is best to start action against any government that takes tax payers money, gives it to oil and gas companies as subsidies, and then does very litte for customers, when O&G producers extort huge amount of money by hiking up bills. There is a good article in the Ecologist which explains some of this. https://theecologist.org/…/20/sir-starmer-and-gas-giants

Neither current candidates for PM is fit for purpose. I just hope that the water companies, also privatised, will not start hiking bills because we are in the throes of a climate change induced drought. The sad thing is, it did not have to be like this, but governments have mismanaged our past and failed to take the right actions to safeguard our childrens future. Nobody wants to pay for carbon capture, avoidance is better than cure. Privatisation of our utilities has not worked for the people of this country.

One of the reasons why UK residents are particularly badly hit by rising energy costs is the reckless failure of this and previous Conservative governments to invest in energy efficiency. So whereas most European countries have been ramping up energy saving programmes, we have seen a more than 80% REDUCTION in investment in energy efficiency over the last decade. It goes back to David Cameron’s infamous ‘cut the green crap’ moment in 2013, when numerous environmental initiatives, including on home efficiency, were axed. Since then, we’ve seen at best half-hearted token efforts, such as Boris Johnson’s ‘Build Back Better’ plan. It collapsed six months later thanks to unrealistic timetables, botched design and the fact that the government did not listen to industry warnings.

Sweden and Germany, for instance, have higher tariffs than we do, but their bills are much lower, because their homes are better insulated and far more energy efficient than ours are.

Britain’s homes are notoriously bad when it comes to energy efficiency, which means they use more gas, oil or electricity to heat. Insulating homes is one of the cheapest ways to cut carbon emissions, as well as saving on utility bills, so why hasn’t it been done? It’s a win-win situation, which the Conservatives are ideologically opposed to, preferring to incarcerate those disparagingly referred to as ‘idiots’ by John ‘I’m alright, Jack’ Minter. To them, burning ever more fossil fuels is always the only answer. It is they who are stuck in the past.

One of the reasons the UK uses so much gas is that as well as having one of the oldest, most inefficient housing stocks in Europe, we’re also failing miserably at building better homes – just 1.8% of new homes in England meet the top efficiency rating, which means the other 98.2% need more energy to heat. It is a dismal and ongoing failure of leadership, the only answer is a change in Government, it can’t come soon enough. Instead, we have Liz ‘It’s my turn to shake the magic money tree’ Truss to look forward to, just more of the same failure.

Well, good point. We’ve had Conservative, Labour and LibDem (in coalition) Governments this century so far. Why not give the Greens a go? We’ve moved on from being a ‘single issue’ party ages ago, and have the necessary radical economic, societal and environmental policies for a saner, safer and happier future for all.

People in Europe are having the same problems as us. This article from The Telegraph is informative – by Juliet Stevens

https://www.telegraph.co.uk/news/2022/08/26/how-governments-cult-net-zero-wrecked-energy-market/

Ten years ago, I flew to Texas to take a tour of the US’s most productive gas field. The Anglo-Australian mining giant, BHP Billiton, had spent $20 billion buying a slice of the Eagle Ford shale field and was trying to convince investors, via the media, that it had been a good idea.

BHP’s oil chief, Mike Yeager, a genteel, walrus-moustached Texan, hosted us on a flight over the woods and meadows of Eagle Ford in a helicopter, took us to see production wells, and introduced us to officials in a county (population 20,000) generating $71 million in gas tax revenues. BHP would spend a further $20 billion developing the field before eventually selling it to BP for just $10 billion. It had bought at the top.

This investment rollercoaster has been on my mind because it was the last time serious new money was put into oil and gas development. Since then, investment has fallen 60 per cent. With it, the stock of proven “reserves” – fossil fuels found and viable for extraction – has fallen more than 50 per cent.

Now the reckoning has come. With Russia cutting supply, prices are rocketing. Since January last year, US gas prices have risen nearly threefold. European gas is up sevenfold. Bills are following suit. Proximately, this is because of Putin. But the reason we are so exposed to the whims of a murderous dictator is under-investment.

Why has there been such dramatic under-investment and why is it that producers are hesitating, when they would normally respond to soaring prices by pushing up production and investment? Well, after the shale writedowns, governments and corporate governance busybodies didn’t just leave the losers to lick their wounds. They mounted a campaign to shut down investment permanently in the lifeblood of the global economy – energy – in the name of saving the planet. What we are now facing are the consequences of these decisions.

The mistakes span governments, continents and decades. They are going to cause untold hardship for millions. They threaten not just our economy and health, but the durability of the Western alliance. Most ludicrously, they risk making semi-permanent the role of coal as an emergency back-up when it’s the dirtiest fuel of them all.

The original error was not with the science of climate change. It was not with the notion that we should phase out coal. But sometime around 2014-16, regulators, lawyers and politicians began to run with the idea that the trashing of “big oil” (and so on) led by students in feathered war bonnets was costless, popular and green.

What followed was a co-ordinated effort to run down fossil fuel production, seemingly without a thought for the vastly different environmental impacts of gas versus coal or the need for Western economies and people to enjoy a reliable supply of energy. In 2015, the then Bank of England governor Mark Carney (yes, him again) gave a speech talking up the risk of climate “stranded assets” – energy investments that would be rendered worthless by climate change legislation.

The EU excluded gas and nuclear from its list of “green” technologies eligible for “sustainable” grants, investment and the like. The UN issued ethical investment guidelines that discouraged putting new money into fossil fuels. Theresa May rammed net zero through Parliament without scrutiny of the cost and slapped the “price cap” on utility firms, which soon after began to go bust by the dozen. Last year, Rishi Sunak added “supporting the net zero transition” to the Bank’s mandate. And the more production we shut down, the more virtuous we felt.

It wasn’t just in Europe. US officials also took up the mantle. States passed net zero laws that, like ours, had no accompanying energy production strategy. Bureaucrats from California to New York began to pressure insurers and oil firms to account for fossil fuel investments or answer in the courts for “climate fraud”. The Keystone XL oil pipeline was blocked. Investors, taken over by righteous and economically illiterate “environmental, social and governance experts”, pressured oil firms to stop investing and banks to stop funding them, and then went on a marketing binge to sell expensive “ethical” investment products.

Industry saw the writing on the wall. Utilities shut down their long-term gas contracting departments and began to buy gas at the going price on the day, fatally undermining security of supply and making new investment un-financeable. Fossil fuel producers began handing money back to investors. Even state-owned producers, like Qatar, cut investment on the basis that Europe (the UK included) had become an unreliable customer. In the first half of this year, even as Russia began to turn the screws, the West’s seven biggest oil firms spent more on dividends and share buybacks than on capital investment. They were only doing as they were told.

And now? Well, now, as “big oil” might say: “We just walked in to find you here with that sad look upon your face.” Europe needs gas. It is pleading for gas. Instead of flying media to gas fields to court capital, the oil and gas men are being flown to the capitals of Europe and begged to invest. Despite the incredible prices, they hesitate.

The meeting goes like this: “We need you!” say the politicians. The producers scratch their heads as they mull $20 billion, 20-year investments, and wonder whether, when the war is over and the green bandwagon rolls back into town, the politicians will still sound so sweet on them. “Your green targets still say we need to shut down by 2030,” they point out. To which Europe says: “Well, of course. Fossil fuels are evil!”

The upshot is that the market is broken and it is governments and do-gooders who broke it. They broke it wantonly, recklessly, touting their saintly intentions, and now we are all reaping the consequences. The only way to resurrect it is with more government intervention.

One scheme sketched out by Lambert Energy Advisory would see the EU and UK collectively co-ordinate utility companies to offer 15-year contracts for enough gas to replace Russian supply, using a dynamic pricing mechanism (that is, we obviously do not lock in 2022 prices for 15 years). The producers who fill the contracts can come from anywhere except hostile states. Do it right and just watch the investment taps – and then the gas taps – turn on at full flow again. And given the lower emissions of gas versus coal, the planet doesn’t even have to suffer.

The alternative is that we continue with a policy of self-sabotage on a truly industrial scale. Politicians can blather about windfall taxes and price freezes all they want. If they don’t repair the market, it is irrelevant. In the meantime, the demolition ball of a self-created gas crisis is swinging through Europe. Will any of our leaders act to stop it?

PS Seeing Parkinson Cowan in the picture at the top of the page brought a lump to my Brummie throat – just one more company (from Stechford) sacrificed when our industry was outsourced – the final manufacturing moving to Poland in 2008 (yes surprisingly more industry lost under Blair than Thatcher) .

A moving paean to the poor old fossil-fuel industry… Heady days in helicopters… But rather than putting the boot in to the energy sector’s arch enemies, the accursed “do-gooders” who have the utter temerity to want to save the planet, I think a bit more focus might have been placed on the pace of transition and the failure to insulate British homes (as mentioned above). This energy crisis, ironically, provides opportunities. It provides a huge opportunity to refocus the minds of the public on the challenges ahead, and on the need to pressure our political representatives to do more than ‘green wash’ their manifestos. And the present drought feels like a fitting back drop, wouldn’t you say? But what this present crisis can’t be is a cynical last gasp opportunity for the fossil fuel industry. ‘I told you so’ might be true from the writer’s perspective, but given the very real climate crisis, it feels, with respect, a little like wasted energy…

It’s ridiculous to caricature ‘do gooders’ as saying ‘fossil fuels are evil’. The science is clear that fossil fuels are burning up the planet, its that simple. If there’s a moral dimension (‘good’ and ‘evil’), then surely its that we should respect our home planet instead of soiling our nest. It’s easy to despair at the huge task ahead of us – my own take is, just try and heal one little patch at a time, as best you can.

“The moral of this story seems to be that if you don’t like the increase proposed for a direct debit payment, challenge it, you might just win.” Win? – the amount of your direct debit is irrelevant. It is the cost of your metered usage that eventually wins, whatever your direct debit. And that promises to be horrendous by all accounts.